Project: Virtuhouse

Market & UX Research

Duration: 3 Weeks

Overview:

Virtuhouse is a real estate service helping users to relocate by viewing properties virtually. The research examined the market competitors and users; young professionals, recent graduates, and university students.

Research Methods

Mixed-Method:

Literary Review (Google Scholar, News Articles)

Competitor Websites

Survey & Interviews (Formal & Informal)

Census Bureau, Data.gov, Kaggle.com

Project Brainstorm & Organization

User #1

Undergraduate Student

Freshman and Sophomores (17-19 yrs)

Junior and Seniors (19-21 yrs.)

What are Undergraduate Student Needs?

Proximity to Campus

Affordability (Roommates)

Proximity to Amenities

Access to Public Transportation

Safety

Private Space

Laundry

Neighbors

Cleanliness

User #1 Location

Why college towns?

87% of students live off campus.

Owning a property near a university and accepting student renters mean reduced vacancies and competitive rents.

Renting to University Students

High Demand:

Many universities and colleges do not offer students four years of housing.

Higher Rents:

Constant demand for housing.

Third Party Payment:

Common for a student attending college to have their rent paid by someone else. Often, parents are the ones who are paying the rent, and they will serve as co-signers on the lease

Word of Mouth Fills Vacancies:

Students may view certain rental properties as very desirable.

Satisfied With Less:

Most college students are not looking for the most high-end finishes.

College Town

Ithaca, NY

State College, PA

Bloomington, IN

Lawrence, KS

Blacksburg, VA

College Station-Bryan, TX

Columbia, MO

Champaign-Urbana, IL

Ann Arbor, MI

Gainesville, FL

Major University

Cornell University

Penn State

Indiana University

University of Kansas

Virginia Tech

Texas A&M

University of Missouri

University of Illinois

University of Michigan

University of Florida

Enrollment

33,451

47,823

44,564

29,512

45,150

60,137

41,057

51,660

76,448

58,453

Population

104,606

158,728

164,233

116,559

181,555

242,884

172,703

237,199

356,823

273,365

Percent

32.0%

30.1%

27.1%

25.3%

24.9%

24.8%

23.8%

21.8%

21.4%

21.38%

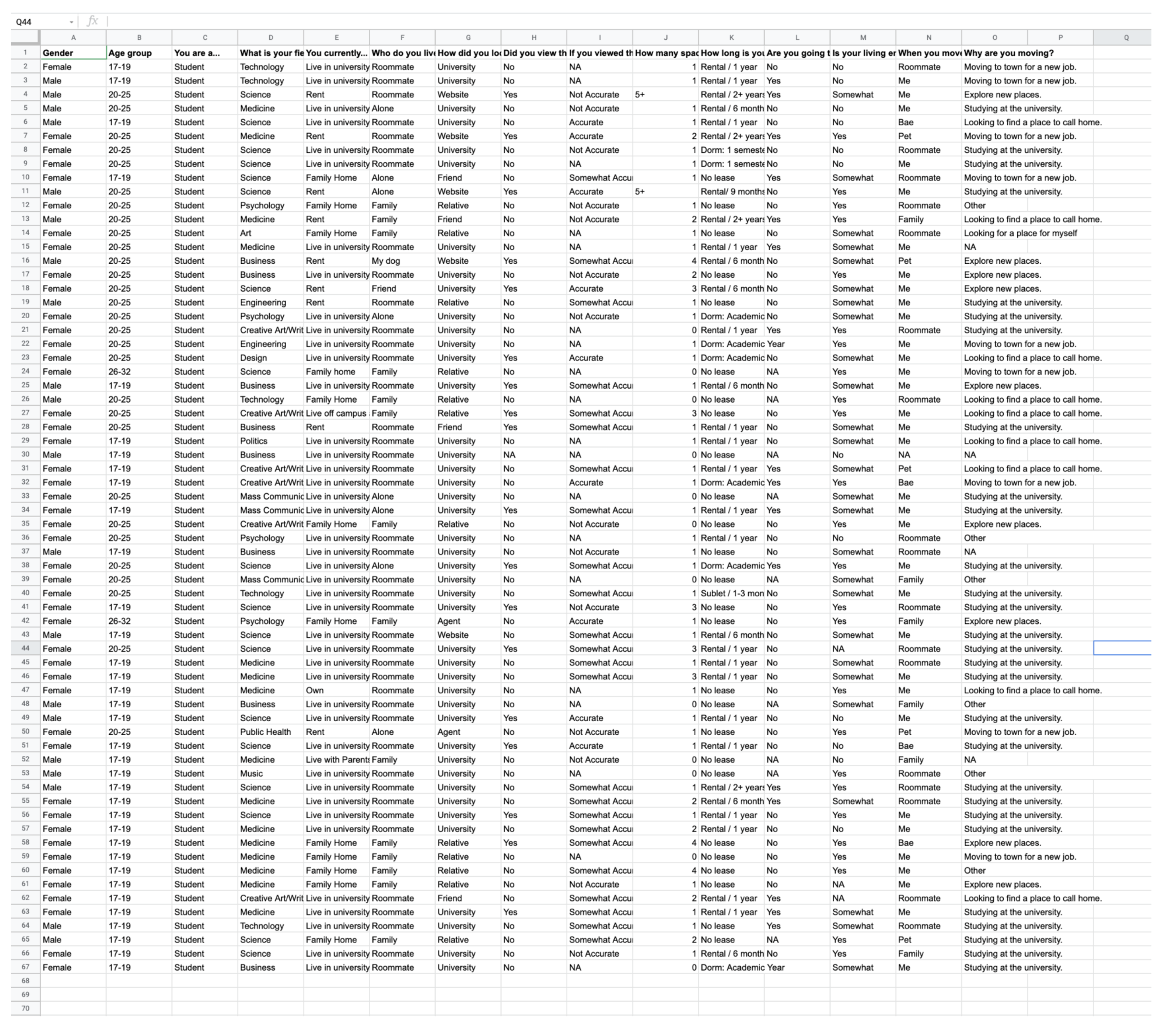

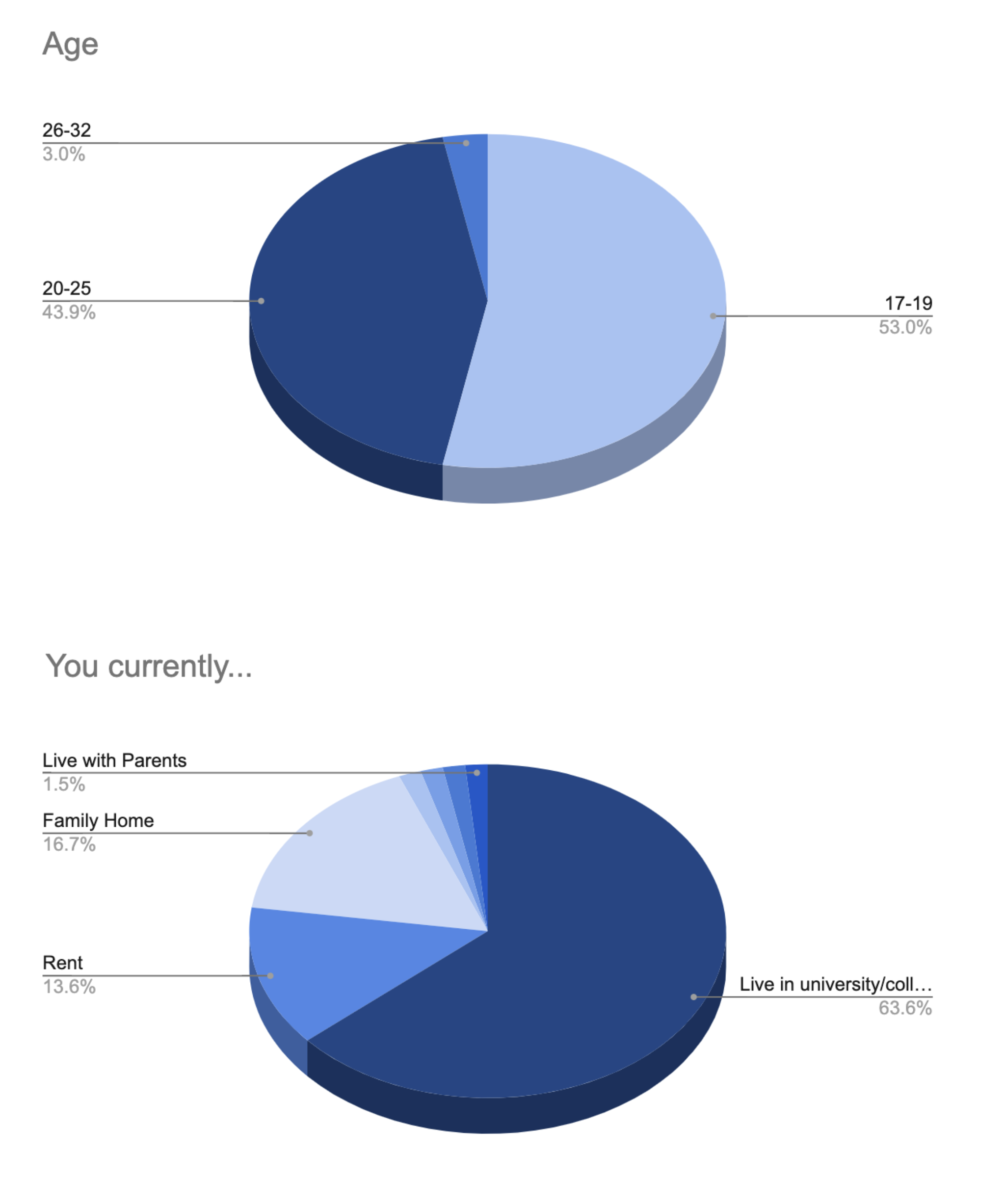

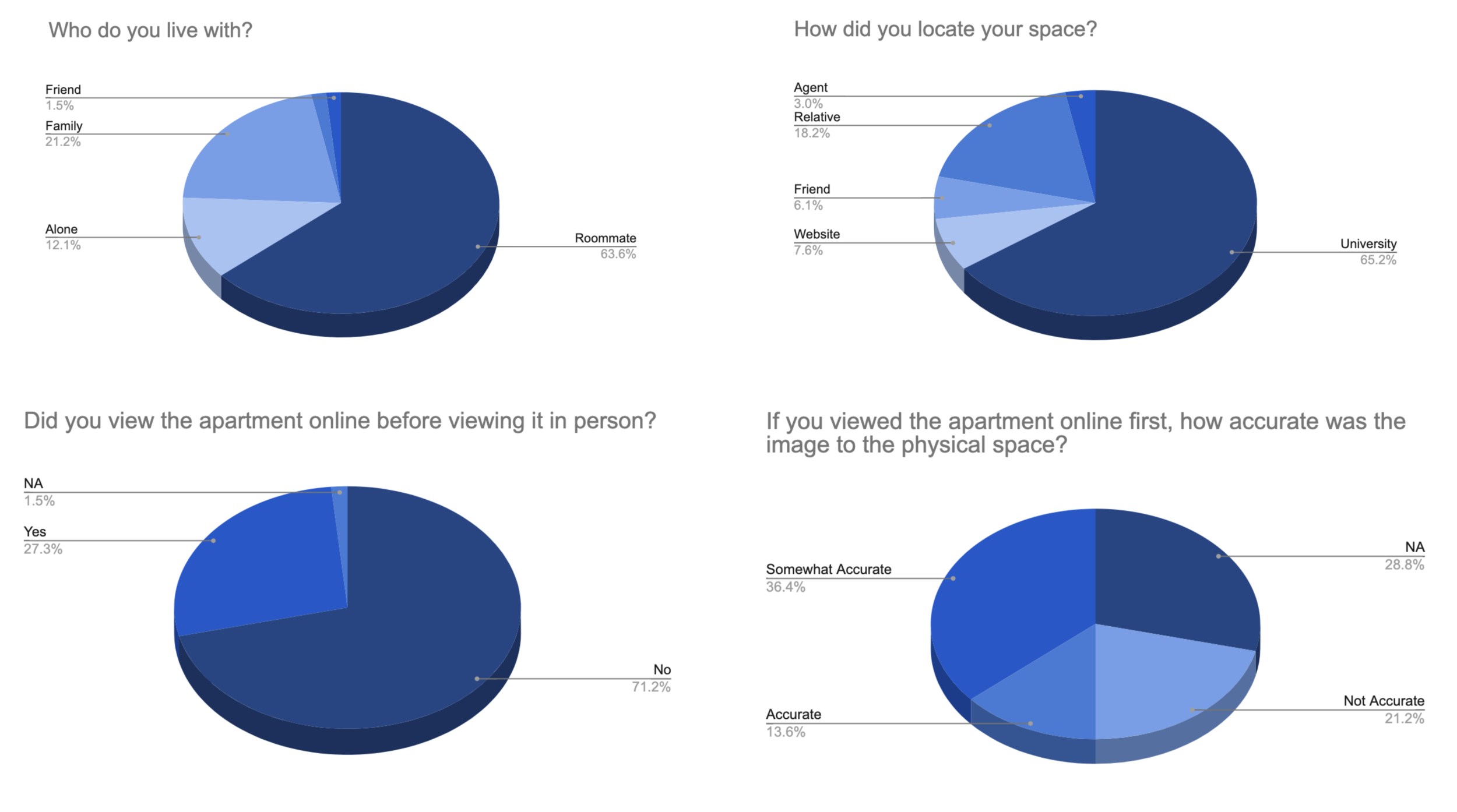

User # 1 Survey

User #1 Market Competitors

Roomrs: This product is similar to Virtuhouse in marketing to students and young professionals. The product is an online rental platform focusing on rentals and rental assistance for university students and young professionals. They offer short-term, flexible leases, individual and roommate rentals, and community.

College Student Apartments: has search tools that help college students find the perfect apartments, houses, roommates, and sublets. With the proprietary Smarter Housing Search, you can find student housing based on the closest distance to campus, best price, and preferred amenities.

Uloop: student marketplace for your college.

College Rentals https://www.collegerentals.com/

Academic Housing https://www.academichousingrentals.com/

Handshake: https://joinhandshake.com/

User #2

Young ProfessionaL

Millennials, Gen Z

What are the users’ needs?

Easy access to center-city jobs

Competitive rental prices

Trendy areas

Social amenities

Business center

Short Term or Long term

Flexibility

Roommates or Single

Key Points

Often second rental experience

Student loan debt requires young professionals to rent rather than buy.

Consistent moving at the end of 6 months or one-year lease.

Prefer temporary lease: “millennials love the idea of being able to pick up and go when their lease is up.”

User #2 Location: Atlanta, GA

Statistics: Atlanta, GA Census 2018

Population estimate 2018, 498,044

Owner-occupied housing, 2014-2018, 43.4%

The median value of owner-occupied, 261,400

Median gross rent 2014-2018, $1,099

High school graduates, 90.3%

Bachelors or higher, 49.9%

Civilian labor force, 65.1%

Median household income, $55,279

Per capita income, $43,468

Each year, millennials move to Atlanta to join its major industries: agribusiness, energy, film, aerospace, and more. The cost of living in Atlanta is reasonable with rentals averaging $1500.

2020

Population, 498,044

Ranks 10th economically in the nation with a GDP of $276 billion. The Atlanta metropolitan area is home to 5.6 million, making it the 9th largest in the United States. In 2018 the annual growth rate was 1.28%. In 2020 it was found that the median age in Atlanta is 33.2 years and within that the median age for males is 32.9 years and females 33.6 years.

According to the most recent ACS, the racial composition of Atlanta was:

Black or African American: 51.85%

White: 40.27%

Asian: 4.16%

Two or more races: 2.41%

Other race: 1.05%

Native American: 0.24%

Native Hawaiian or Pacific Islander: 0.03%

User #2 Market Competitors

Rentberry: An online rental marketplace bringing landlords and tenants together, eliminating the need for real estate agents in the rental niche. This alone has not only sped up the process for both landlords and renters, but also minimized costs and maximized profit for both groups. Landlords and renters can negotiate the rental rate directly, reaching a mutually acceptable rate.

Bungalow: An aesthetically pleasing and user-friendly site, uniquely focused on rentals and roommate location. Like Roomrs, Bungalow provides rental advice and community. https://bungalow.com/

Zillo: identifies rentals as a large market opportunity since renters move more often than homeowners and property owners have to spend money on advertising and lease concessions.The network includes Zillow products; Trulia, Hotpads, MyNewPlace, AOL Real Estate, and MSN Real Estate. Industry also listed Zillo as a leader, as well as Apartments.com and Zumper.